What is BFUSD? A Complete Guide to Binance-Pegged USD and How It Works

What is BFUSD?

BFUSD is a stablecoin issued by Binance, one of the world’s largest cryptocurrency exchanges. It is pegged to maintain a value equivalent to that of the US dollar (USD). Essentially, 1 BFUSD equals 1 USD, making it a very valuable tool for traders and investors to minimize their price volatility while operating in the cryptocurrency market.

Stablecoins like BFUSD fill in the gap between the traditional financial systems and the crypto ecosystem, facilitating smoother transactions, hedging against market fluctuations, and making cross-border payments more streamlined.

How Does BFUSD Work?

BFUSD works based on blockchain technology. This way, it becomes transparent, secure, and non-erasable. Here is how it works:

Binance Pegging Mechanism:

Binance creates BFUSD by pegging it 1:1 to a fiat USD reserve. This means for every BFUSD in circulation, there is an equivalent amount of USD held in reserves to back it.

Regular audits ensure that the reserves match the circulating supply, fostering trust among users.

Supported Blockchains:

BFUSD is available on several blockchains, including Binance Smart Chain (BSC) and Ethereum. This cross-chain compatibility makes it versatile and widely usable across different platforms and decentralized applications (dApps).

Decentralized Transactions:

The user can send, receive, and trade BFUSD directly without intermediaries like banks. This means that transactions are characterized by low fees, fast processing, and borderless transfers.

Stability and Security:

BFUSD’s value is tied to the US dollar, which minimizes the volatility commonly seen in other cryptocurrencies like Bitcoin or Ethereum.

It leverages the security of its underlying blockchain networks to protect transactions from tampering or fraud.

Key Features of BFUSD

Price Stability:

Unlike volatile cryptocurrencies, BFUSD maintains a consistent value of 1 USD, providing users with a reliable store of value.

Transparency:

Binance regularly publishes reports on the reserves backing BFUSD, ensuring users can trust the token’s value.

Wide Usability:

BFUSD can be used for various purposes, including trading, payments, savings, and lending on DeFi platforms.

Low Transaction Fees:

Transacting with BFUSD is cost-effective compared to traditional banking or other cryptocurrencies.

Cross-Chain Compatibility:

The ability to operate across different blockchain networks enhances its flexibility and usability in diverse crypto ecosystems.

Use Cases of BFUSD

Trading and Hedging:

Traders often convert volatile cryptocurrencies into BFUSD to lock in profits or minimize losses during market downturns.

Payments:

Businesses and individuals can use BFUSD for payments due to its stable value and fast processing times.

Savings:

Users can store value in BFUSD as an alternative to holding fiat currency in traditional bank accounts.

Decentralized Finance (DeFi):

BFUSD is widely used in DeFi protocols for lending, borrowing, and earning interest on deposits.

Cross-Border Transactions:

Its borderless nature makes it ideal for remittances and international transactions without hefty bank fees.

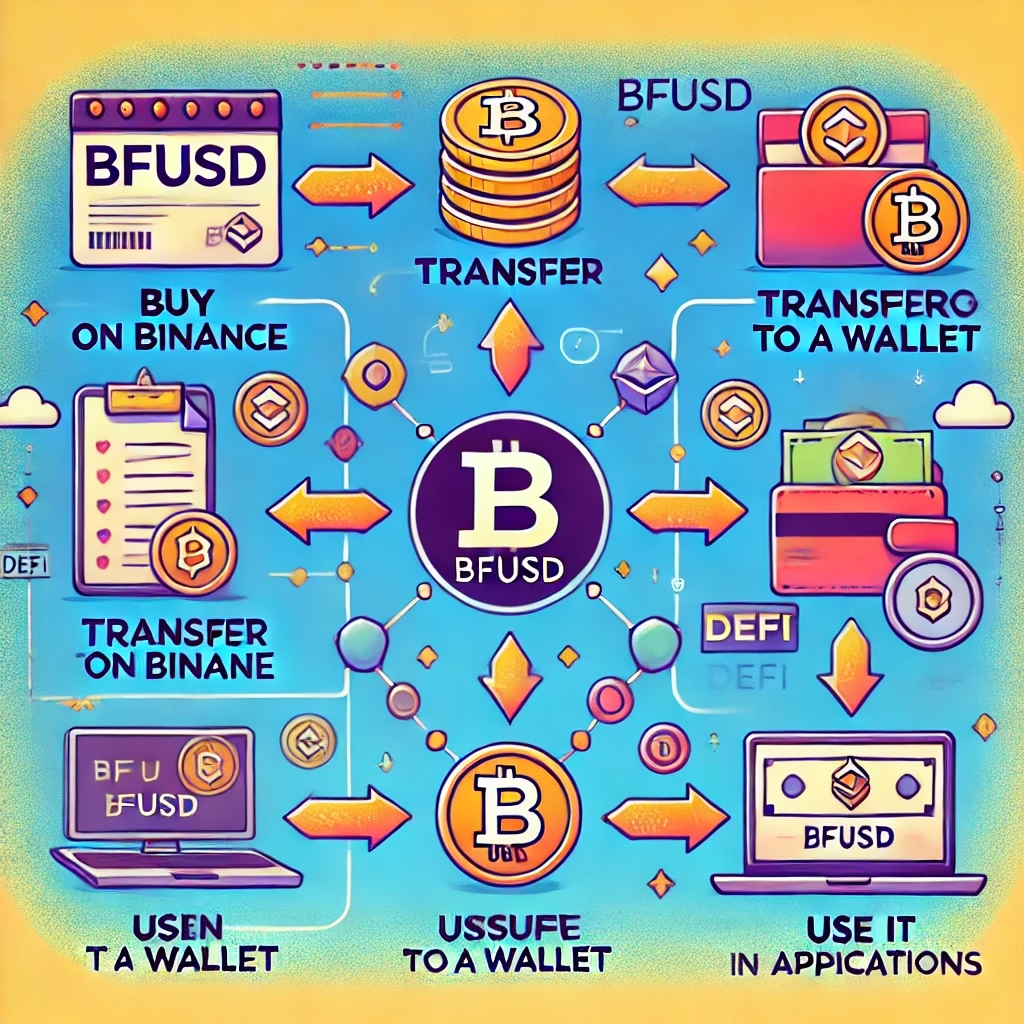

How to Buy and Use BFUSD?

Create an Account on Binance:

Sign up for a Binance account if you don’t already have one.

Deposit Funds:

Deposit fiat currency (USD, EUR, etc.) or cryptocurrencies into your Binance wallet.

Purchase BFUSD:

Navigate to the trading section, select the BFUSD pair you want to trade, and complete your purchase.

Store BFUSD Safely:

Keep BFUSD in a secure wallet, such as a hardware wallet or a trusted software wallet, to ensure its safety.

Use BFUSD:

You can trade it for other cryptocurrencies, send it to friends or family, or utilize it in DeFi applications.

Advantages of Using BFUSD

Reduced Volatility:

BFUSD’s peg to the USD ensures price stability, making it ideal for risk-averse users.

Global Accessibility:

Anyone with an internet connection and a crypto wallet can use BFUSD, enabling financial inclusion.

Fast Transactions:

Blockchain-based transactions are processed quickly, often within minutes.

Transparency:

Binance’s commitment to regular audits and reporting fosters trust.

Integration with Binance Ecosystem:

BFUSD integrates seamlessly with Binance’s wide range of services, including spot trading, futures, and staking.

Risks and Considerations

Centralized Issuance:

Since BFUSD is issued by Binance, it relies on the exchange’s credibility and reserve management.

Regulatory Risks:

Governments can regulate stablecoins, which may limit their use.

Security

Blockchain is secure, but users must protect their wallets from hacking or phishing attacks.

Dependence on Reserves

BFUSD’s stability depends on the sufficiency and transparency of Binance’s USD reserves.

Conclusion

BFUSD is a great tool for anyone looking to navigate the crypto world with minimal exposure to volatility. Its stable value, transparency, and wide range of applications make it a preferred choice for traders, businesses, and individuals alike.

However, users should remain aware of the associated risks and take necessary precautions to secure their assets. Whether you are trading, investing, or simply exploring the crypto ecosystem, BFUSD offers a stable and efficient way to interact with digital assets.